tax attorney vs cpa salary

Here are 22 accountant jobs in order from least to greatest national average salary. Tool requires no monthly subscription.

Enrolled Agent Vs Cpa Which Certification Is Better For You

6 to 30 characters long.

. Thomas Brock CFA CPA is a financial professional with over 20 years of experience in investments corporate finance and accounting. Get breaking Finance news and the latest business articles from AOL. Apply for Power of Attorney Form W-7.

Urban High School Student. Clients use a tax attorney if they need to go to court or meet with the IRS about their financial situations. You must maintain at least 75 of each employees total salary.

To get the 501c3 status a corporation must file for a Recognition of Exemption. Salary potential can increase with advanced degrees and more experience. Hiring an attorney or CPA will cost between 1000 and 3000.

The amount that you pay your accountant or your attorney is a tax-deductible expense. Big Blue Interactives Corner Forum is one of the premiere New York Giants fan-run message boards. Join the discussion about your favorite team.

Set up systems and processes in place that guarantee accurate records and streamline compliance. Payroll Department that determines amounts of wage or salary due to each employee. Engine as all of the big players - But without the insane monthly fees and word limits.

Must contain at least 4 different symbols. Direct vs Indirect Costs. CPA vs EA vs Tax Attorney.

This means that any sum paid for filing personal taxes is not allowed and neither are any amounts paid for legal matters that dont pertain to your company. We stand by our work year in year out. From stock market news to jobs and real estate it can all be found here.

They are tasked with recording and presenting financial standings and reports to management. You have received more than 410 euros worth of salary replacement income such as child benefit sickness benefit maternity pay or. A tax attorney often works for large businesses and helps them file corporate taxes.

Become a Tax Attorney. Over 500000 Words Free. Content Writer 247 Our private AI.

NW IR-6526 Washington DC 20224. We welcome your comments about this publication and your suggestions for future editions. Wages and salary expenses.

This is a list of salaries of heads of state and government per year showing heads of state and heads of government where different mainly in parliamentary systemsOften a leader is both in presidential systemsSome states have semi-presidential systems where the head of government role is fulfilled by both the listed head of government and the head of state. That brings the total taxes due to 10150 on this flip. IRS Publication 587.

ASCII characters only characters found on a standard US keyboard. Investment Management and Finance Professional. Business Use of Your Home Including Use by Day-Care Providers.

Pre-tax deductions are money taken out of your wages or salary before you. Peer review A practice monitoring program in which the audit documentation of one CPA firm is periodically reviewed by independent partners of other firms to determine that it conforms to the standards of the profession. Top accounting jobs.

Pending Legal proceedings not yet decided. Its best to talk to an attorney or CPA before deciding which business structure is best for you. Become a Tax Accountant.

The average entry-level accounting professional annual salary in the United States ranges from 29620-46070. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. I strongly suggest you consult a CPA or tax attorney soon before you sign on the dotted line so you know ahead of time what your tax obligation.

Draft your articles of incorporation. Bookkeepers are responsible for maintaining the day-to-day financial occurrences of a company. A document published by the Internal Revenue Service IRS that provides information on how taxpayers who use.

Clients may also receive additional consulting from a CPA or an enrolled agent to handle their personal filing matters. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. The investors ordinary tax rate is 23 so the income tax owed on the flip is 6095 26500 x 23.

Starting with the 26500 of profit then subtracting whats needed to pay taxes the investor is left with 16350. Apply for an ITIN Circular 230. Become a Real Estate Appraiser.

Paying yourself from your LLC is easier than you think Running a successful small business is. Their expertise is more than worth the cost. This requirement applies to every employee that received less than 100000 in annualized pay in 2019 or 2020 depending on what year you used to calculate your PPP loan amount.

Salary and bonuses at their personal tax rate. Have an experienced CPA and tax attorney on your side. Ordering tax forms instructions and publications.

Fringe benefits which are usually tax-free. 43861 per year Primary duties. Papers from more than 30 days ago are available all the way back to 1881.

Of course the payment should be for business-related work. Call 800-829-3676 to order. This was exactly what I needed.

Comparison of Education Advancement Opportunities for Low-Income Rural vs. What Expenses Can Be Deducted. Dividends taxed at a maximum rate of 15 percent.

A 501c3 is a corporation that receives tax-exempt status from the Internal Revenue Service IRS. Bar or CPA Review Course. Because while the CEO of a large organization is not spending much time working with the plants a portion of their salary may be deductible under 280E tax law.

Teaching and Related Duties. But if this annuity is being given to you in lieu of salary and youll own it then you may actually owe taxes on the full cost of annuity even though you didnt receive the lump-sum to buy it. Which should you hire and why.

Go to IRSgovOrderForms to order current forms instructions and publications. Thank you so much. There is a fee for seeing pages and other features.

Tax Attorney Vs Cpa What S The Difference

When You Should Hire A Cpa Or Tax Pro Reviews By Wirecutter

Cpa Salary Guide 2022 Find Out How Much You Ll Make

Rjs Law San Diego Tax Attorney Irs Ftb Cpa California

What S The Difference Between A Cpa And A Tax Attorney Quora

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Tax Attorney What S The Difference

Cpa Vs Lawyer Top 10 Best Differences With Infographics

4 Types Of Tax Preparers Turbotax Tax Tips Videos

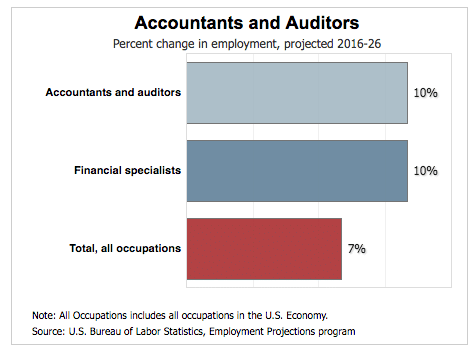

Do Accountants Make Good Money Zippia

Cfa Vs Cpa Salary Who Makes More Kaplan Schweser

How To Choose The Perfect Accounting Career Path For You

Cpa Average Salaries Wages By State 2022 Career Outlook

![]()

Enrolled Agent Vs Cpa Which One Is Better For You Beat The Cpa 2022

Cpa Vs Mba Which Is Better For Your Career Salary 2022 Update

/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)